Using Put/Call Open-Interest to Predict the Rest of the Week

热1已有 472744 次阅读 2010-05-18 16:51Using Put/Call Open-Interest to Predict the Rest of the Week

by admin on May 18, 2010

in Essays/Reports/Articles

Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

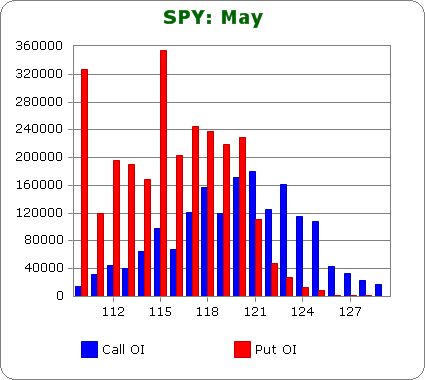

SPY (closed 112.40)

Puts out-number calls almost 2-to-1, so bearish sentiment remains.

Call OI is highest between 115 & 125.

Puts OI is highest at 121 and below.

There’s lots of overlap between 115 & 121, but since puts out-number calls, a close in the top-half of the range would cause the most pain, but unlike previous months, someone will make money – there’s no place to close were most options will expire worthless. Given Tuesday’s close at 112.40, the market not only needs to move up a couple points, it needs to get above last week’s high.week.

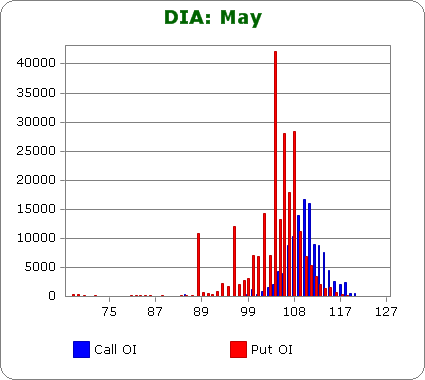

DIA (closed 105.39)

Puts out-number calls by 1.3-to-1, so bearishness has again slipped into the Dow. In previous months, when the market was trending up, DIA puts and calls were about equal.

Call OI is highest between 108 & 111.

Put OI is highest 104 & 108.

With little overlap between the two ranges, it’s easy to determine what price will cause the most pain – 108. With DIA’s close at 105.39 Tuesday, the stock needs to move up a couple points the rest of the week to cause the most pain.

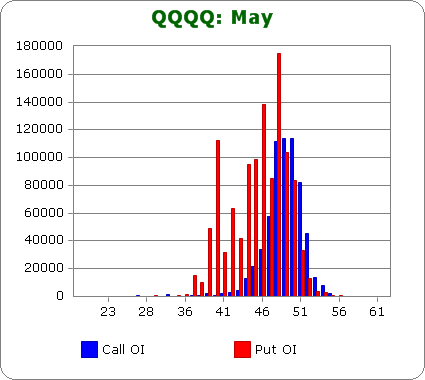

QQQQ (closed 46.43)

Puts out-number calls by 1.8-to-1.

Call OI is highest between 46-52.

Put OI is highest between 44 & 50 with a spike at 40.

Overlap of the biggest spikes takes place between 48-50, so a close around 49ish would cause the most pain. With Tuesday’s close at 46.43, a move up to at least 48 is needed the rest of the week.

IWM (closed 68.35)

Puts out-number calls by 2.1-to-1.

Call OI is highest between 67-75.

Put OI is highest between 63-71.

There’s overlap between 67 & 71, but since puts dominate, let’s focus on those. Without “asking too much,” a close near 71ish would cause lots of pain among put buyers. A close slightly lower than that would be fine too because even if those puts had some value, the value wouldn’t be high enough to enable profits. With Tuesday’s close at 68.35, a slightly up market would do the trick.

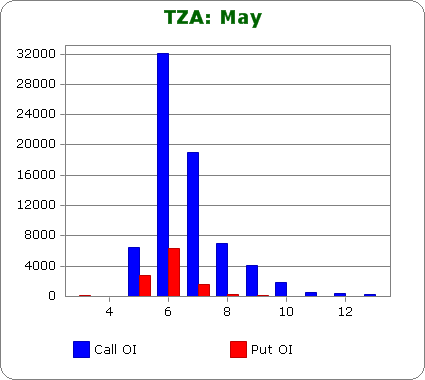

One more just for fun.

TZA (closed 6.43) – this is 3x inverse small cap ETF.

Call OI dominates again.

Call OI is highest at 6 and 7.

Put OI is nonexitent.

A close at 6 would expire most of those calls worthless and considering the stock didn’t trade at the low (5.3) long, those who bought the 5 calls won’t make much either. These numbers tell us the market needs to move up the rest of the week so this stock can pull back.

Overall Conclusion: After many months of trying to pick a top, it appears the bears will finally win. For the first time since I started writing these reports, the bears are in the money, and barring a very healthy move up the next three days, they’ll make money.

发表评论 评论 (1 个评论)