黄金美元都有牛熊两种数法,为什么sp全是熊?为什么0903以来的一定是abc反弹浪,而不是创新高的主升浪?

pdz 发表于 2011-4-2 23:02

Thank for gold count.

Do you have Silver too ???

This is my silver count, can you please comment your idea? I'm bullish. I believe silver will reach $40 before open new lower.

...

snowrider, my english is not good, sorry.

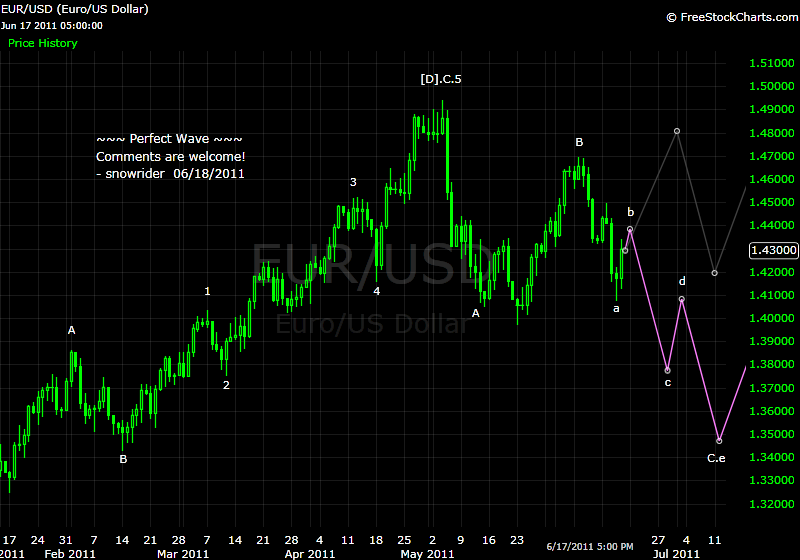

In your chart above, you mean we have a FLAT 3-3-5? And that FLAT is wave B of higher ZIGZAG?

...

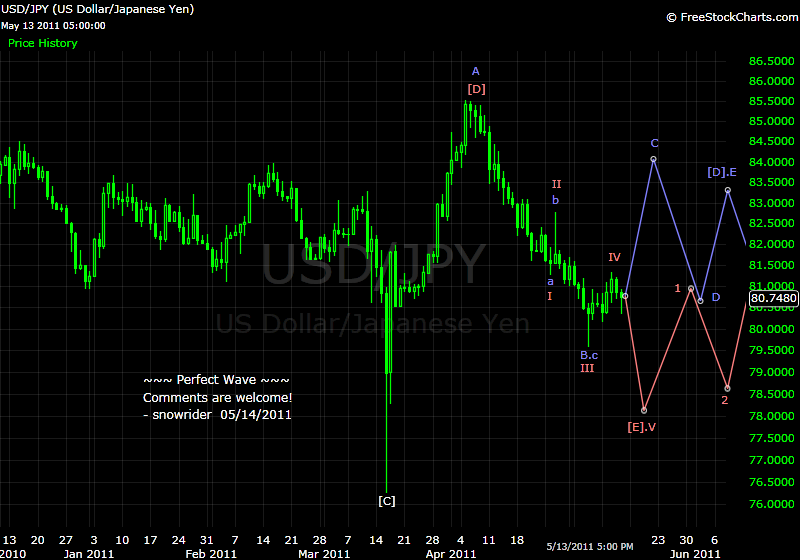

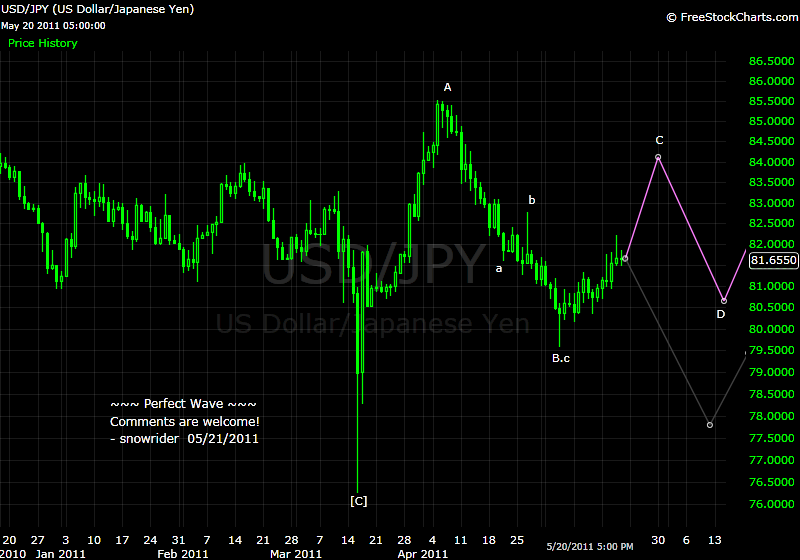

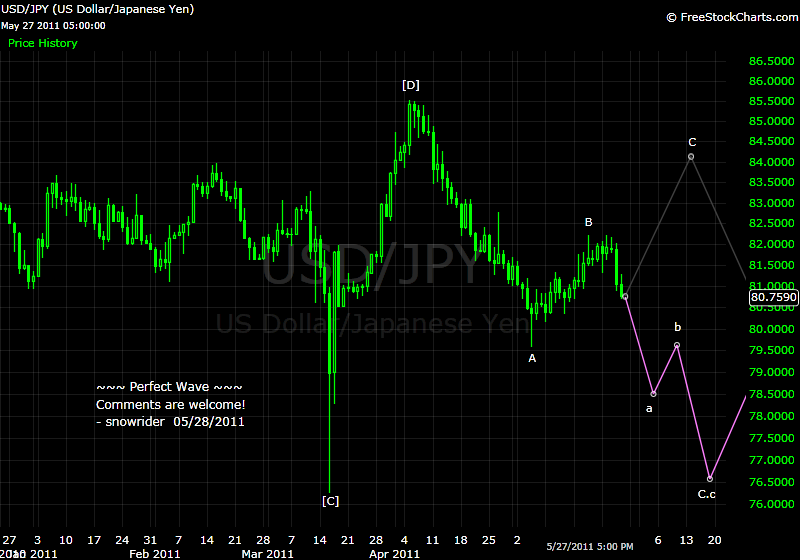

snowrider, can you please share your U/J weekly or monthly count? I'm interest in this chart, but do not know when to begin. My chart begin at 1 Apr 1989 and it's hard to count this chart ( impluse or corrective wave???)

| 欢迎光临 华人论坛 (http://www.huarenv5.com/forum/) | Powered by Discuz! 7.2 |