iPad, Apple, And The Next Week (Or So)

热3已有 26179 次阅读 2010-04-06 22:30|

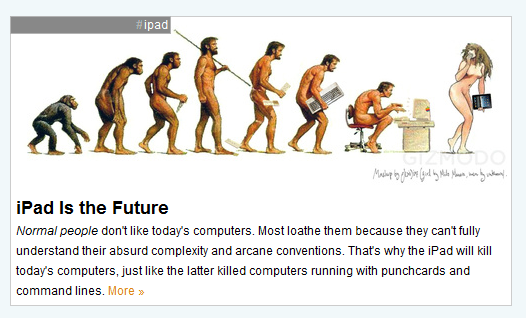

iPad, Apple, And The Next Week (Or So) Posted: 06 Apr 2010 06:03 AM PDT This post is out of the norm, but I just can't resist. It's about Apple (AAPL), but more specifically the iPad, human behavior and why I think it's due for a short-term dip. First, let me get the actionable out of the way. Apple stock recorded a perfected sell setup according to DeMark analysis on Thursday. This has happened 8 other times since the March 2009 market bottom: 3/23/09, 4/16/09, 6/5/09, 7/23/09, 9/17/09, 11/17/09, 1/4/10, 3/9/10. Check out Apple's price action in the week or so following the dates. Not great. Now for the context. I spent an inordinate amount of time over the weekend doing line checks (get a life, right?). I obviously saw the news reports about Apple stores, but I saw no shortages whatsoever, especially at Best Buy. You could get in and out in 5 minutes...either there's not much demand, or Apple really stocked them (which I didn't think was likely because they like the hype of "sellouts"). Sunday afternoon Twitter blew up with reports from a Piper analyst that suggested 700k iPads were sold. I thought that was ridiculous, especially when I found out he got that number by counting ~700 people at an Apple store and said that was double the people he counted for the iPhone, so he doubled that estimate. I laughed out loud, but everyone took the estimate as gospel. I couldn't believe it. That was especially the case because there were so many mixed reviews. Everyone loved the screen, but the clear conclusion was that as of now, it's just a luxury entertainment device. With wifi problems. And no Flash support. Which is too heavy. And awkward for typing. And slippery. And smudgy. Without a camera. Or USB. Or Microsoft Office support. During the worst employment scenario in 80 years. I think there will be heavier-than-expected returns, and a steeper-than-expected drop-off after the first weekend. Those that rushed out are either early adopters who will buy everything, or hangers-on that want to look cool. After spending $1000 (after taxes, extended warranties, add-ons, etc), they feel they have to justify the purchase. That shouldn't last long. Perhaps this cartoon says it all about the hype: Like I said, this isn't my usual cup of tea. But it's an extraordinarily interesting moment for Apple. And since that one stock makes up 17% of the Nasdaq 100, more than triple the next largest component, as goes Apple so goes the NDX. Maybe Thursday's announcement of the next installment of the iPhone will bring enough enhancements to justify all the price upgrades that came out on Monday (I hope so, since I own an iPhone and bemoan the missing features). And maybe their staggered rollout plan (3G, then foreign sales) will also be enough to keep shoveling coal on the fire. But for now - like the next week or so - I think the chances are better for weakness as opposed to a continuation of the momentum...a break below $235 would be good confirmation of that. Thursday's event is a wild card, so we'll have to see how that goes. |

发表评论 评论 (2 个评论)